A stop order is an instruction to your broker to execute a trade at a particular level that is less favourable than the current market price.

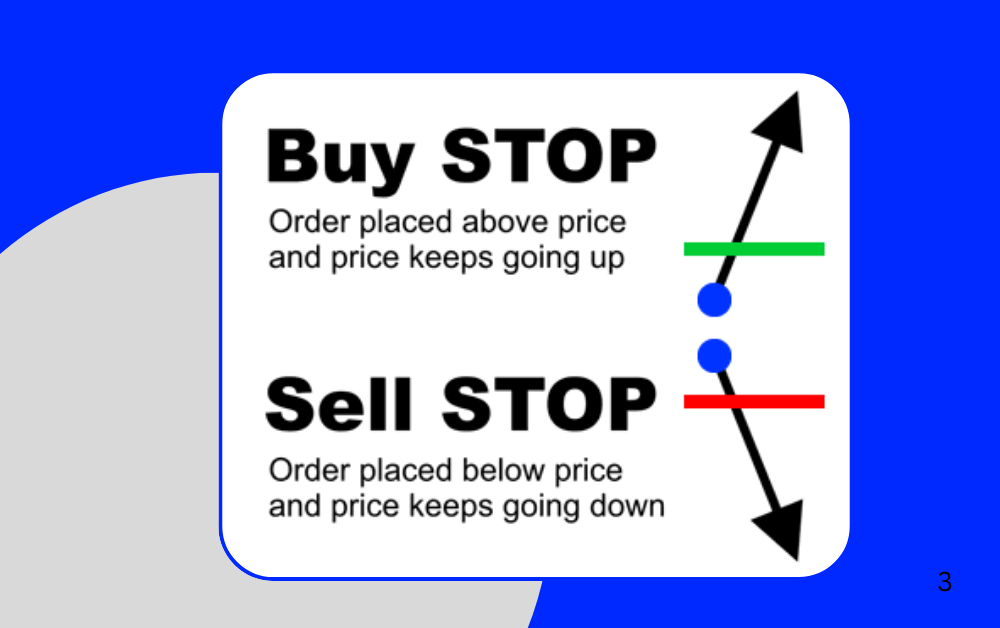

It is an order placed to either buy above the market or sell below the market at a certain price.

They are made to function automatically, saving you the trouble of continuously monitoring the market to see if prices will move against you.

When prices fluctuate quickly and you do not have time to manually close out a trade that has gone against you (for stop-loss orders) or open one during a brief window of opportunity (for stop-entry orders), this could be especially helpful in volatile markets.

This type of order is especially useful for protecting profits or limiting losses. Understanding how stop orders work can make your trading journey much smoother and more efficient.

In This Post

Types of Stop Orders

Stop orders come in different forms, each designed for specific purposes. Here are the main types:

1. Stop-Loss Order

Stop-loss orders can also result in a profit if they are placed above the initial level (for a long position, or below it for a short one).

Your stop-loss order is activated when the predefined price limit is reached, and a market order is used to close the position at the current market prices.

This helps you limit your future losses by enabling you to exit a trade when the price swings against you and reaches a predetermined level of loss.

Stop-loss orders are frequently used as risk management tools. They are set at a price that is lower than your opening position and are based on the amount of loss you are comfortable with in each trade.

2. Stop-Buy Order

A stop-entry order, which is the reverse of a stop-loss order, is used to open a position when the market reaches a specific level.

Your stop-entry order level will be higher than the current price if you’re purchasing (going long).

Your stop-entry order will be below the current price if you’re selling (going short).

One useful tactic for hedging or possibly trading a rapid market upswing or downturn is to open a stop-entry order position while the market is moving against you.

For instance, suppose you think the EUR/USD exchange rate would rise sharply and quickly if it falls to a particular level. In order to profit from this, you place a stop-entry order, initiating a long position in the event that your prediction is correct.

Why Use Stop Orders?

Stop orders are an essential tool for both beginner and experienced traders. Here’s why they’re so valuable:

Risk Management

Stop-loss orders can prevent significant financial losses by automatically selling your investment at a pre-set price.

Emotion Control

Trading can be emotional. Using stop orders helps you stick to your strategy without second-guessing yourself.

Convenience

Once you set stop orders, you don’t have to monitor the market constantly. The order will execute automatically.

Things to Keep in Mind while use Stop Order

While stop orders are useful, they also come with some considerations:

In highly volatile markets, stop orders can trigger unexpectedly due to sudden price swings.

Gaps in Prices

If a stock’s price gaps overnight, your stop order might execute at a much lower or higher price than expected.

Execution Timing

Stop orders become market orders once triggered, meaning the actual execution price might differ slightly.

How to Set a Stop Order

Setting a this is simple:

- Log in to your trading platform.

- Choose the stock or asset you want to trade.

- Select “Stop Order” from the order type options.

- Enter your stop price.

- Confirm the details and place your order.

Most trading platforms provide clear instructions, making it easy to set up stop orders even if you’re a beginner.

Related Term