Andrews’ Pitchfork is a popular tool in technical analysis. It helps traders identify potential market trends and price channels. Dr. Alan Andrews developed this indicator to help traders predict future price movements and spot support and resistance levels.

In This Post

What Is Andrews’ Pitchfork?

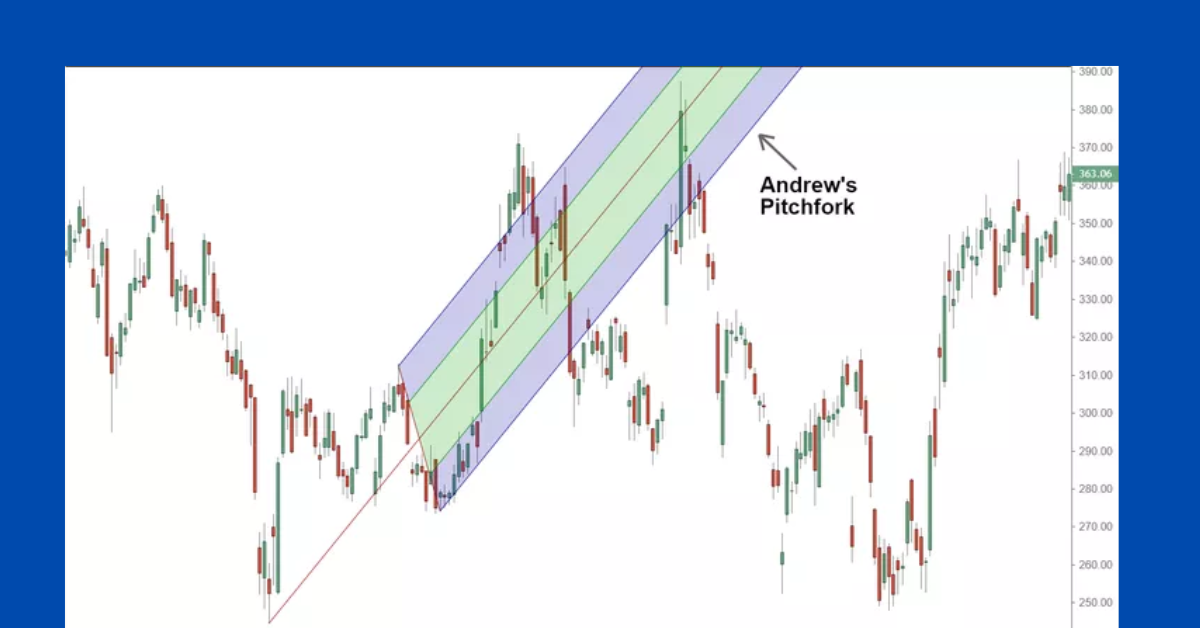

Andrews’ Pitchfork consists of three parallel lines: the median line and two equidistant lines above and below it. These lines are based on three significant points, often called pivots, on a price chart:

- Point A: This is the starting point, often a major peak or trough.

- Point B: The first reversal point following Point A.

- Point C: The second reversal point after Point B.

By connecting these points, traders create a channel that highlights potential price movements. This channel often acts as a guide for identifying trends and possible reversal zones.

This indicator is called a “pitchfork” because of the shape that is created on the chart.

How to Draw Andrews’ Pitchfork

Using Pitchfork is simple when you follow these steps:

- Identify the Pivot Points: Start by locating Point A (a significant high or low), followed by Points B and C (subsequent reversal points).

- Draw the Median Line: Connect Point A to the midpoint between Points B and C.

- Add the Parallel Lines: From Points B and C, draw lines parallel to the median line.

This creates a pitchfork-like structure. The price tends to oscillate within these lines, offering traders insights into potential future price action.

Why Use Andrews’ Pitchfork?

Traders use Andrews’ Pitchfork for several reasons:

- Trend Identification: The slope of the median line shows the overall market trend. A rising median line suggests an uptrend, while a falling line signals a downtrend.

- Support and Resistance: The parallel lines act as dynamic support and resistance levels, helping traders make better decisions.

- Reversal Signals: When the price moves outside the pitchfork’s boundaries, it may indicate a trend reversal.

- Entry and Exit Points: Traders often use the upper and lower lines to set entry and exit points for their trades.

Tips for Using The Pitchfork Effectively

To get the most out of this tool, follow these tips:

- Combine It with Other Indicators: Use tools like RSI or moving averages to confirm signals.

- Adjust for Market Conditions: Markets don’t always move in perfect channels. Be flexible and adapt your analysis as needed.

- Practice Before Trading: Experiment with Andrews’ Pitchfork on demo accounts to gain confidence.

Frequently Asked Questions

What markets can I use Andrews’ Pitchfork in?

Andrews’ Pitchfork works well in forex, stocks, commodities, and even cryptocurrency markets.

How reliable is this tool?

Its reliability depends on correctly identifying pivot points. Combining it with other analysis methods improves its accuracy.

Can beginners use It?

Yes! While it may seem complex at first, practice makes it easier to use effectively.

Conclusion

Andrews’ Pitchfork is a versatile tool that helps traders identify trends, support, and resistance levels. When used correctly, it provides valuable insights into price movements. To enhance your trading strategy, combine Andrews’ Pitchfork with other indicators and always stay adaptable to market changes.

Related